For over a decade pundits have been predicting the demise of insurance agents. The predictions were that online sales would soon dominate the market. Against the predictions of these pundits, insurance agents continued to thrive. Then 2019 arrived. It didn’t arrive in the way the pundits predicted. Instead, the future arrived in the form of increasing headwinds for regional carriers. This post identifies this important trend impacting the industry and how carriers and agents need to respond.

An Evolving Sales Channel

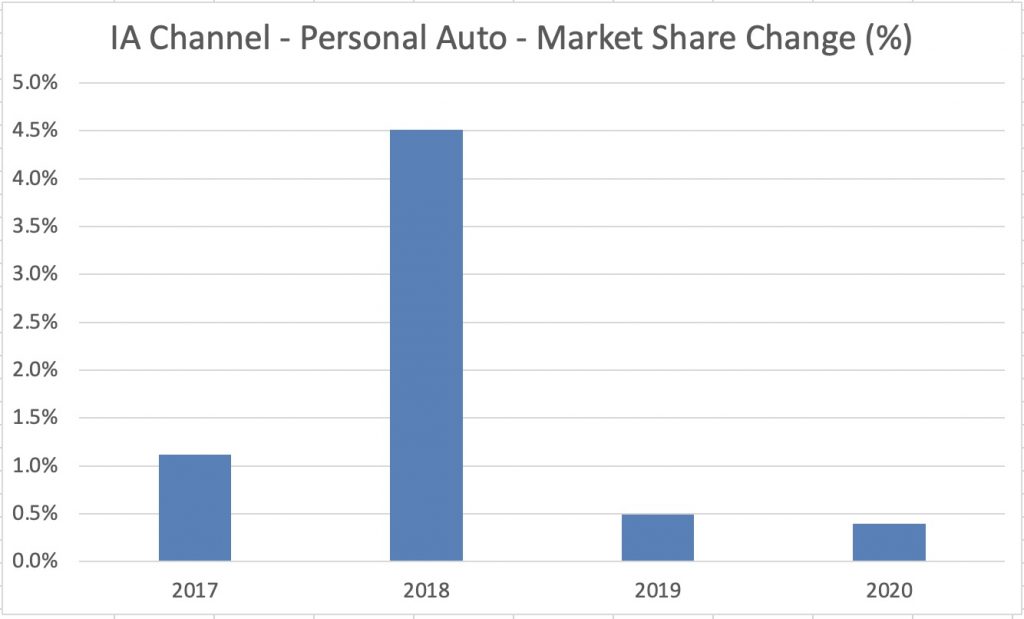

In 2019 the independent agent channel for personal auto slowed to less than one-half a percent growth. Notably, this was one-year prior to COVID. For details, see image 1 below.

IA Channel Growth Rate, Personal Auto

Image 1: Growth rate measured in percentage (%) change in market share as compared to the total market. Data – AM Best: Used with permission.

The significant increase in growth in 2018 is largely attributed to Nationwide moving from the captive to the independent agent channel.

IA Channel Growth Rate, Personal Auto, Progressive vs. Other Carriers

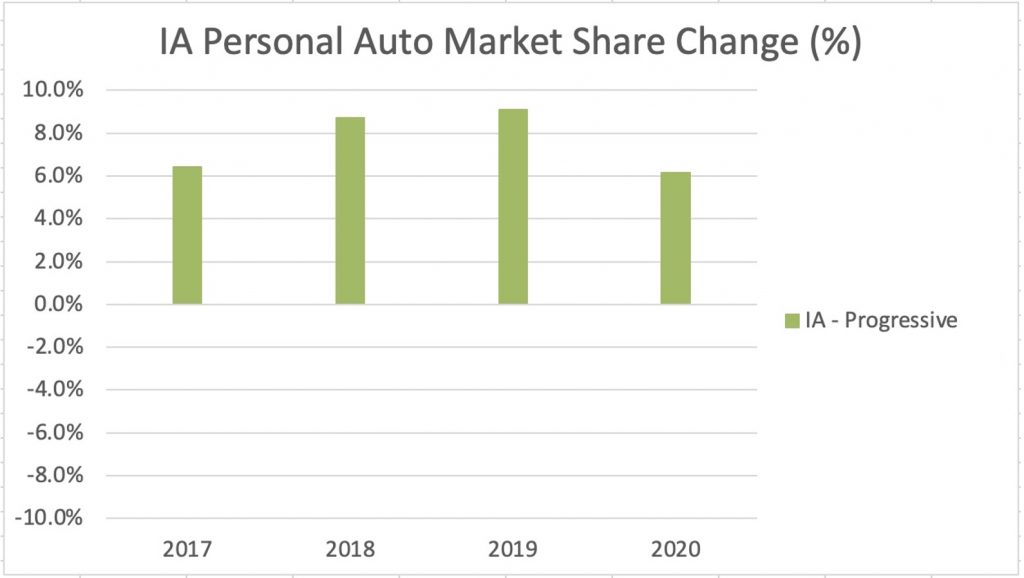

Progressive is the reason the overall IA channel grew. Progressive market share in the IA channel increased by an impressive 9% and 6% respectively for 2019 and 2020. See image 2 below.

Image 2: Growth (measured in market share change) for Progressive in the IA channel for personal auto insurance. Data – AM Best: Used with permission.

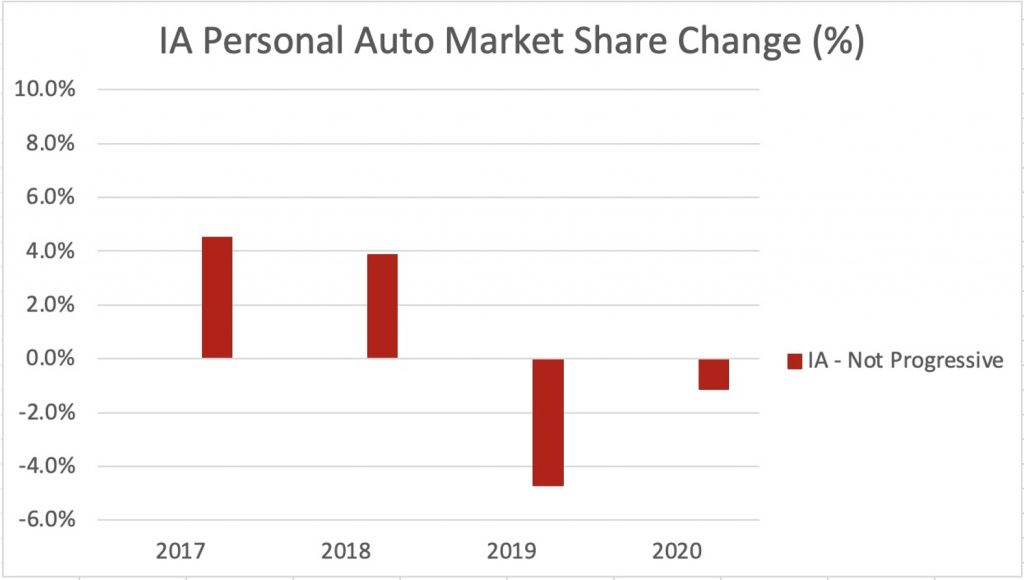

However, market share growth was not widely enjoyed by carriers selling through the IA channel. For the sum of all other carriers (other than Progressive), 2019 and 2020 marked a decline in market share. Nationwide’s move from captive agents to independent agents buoyed the market share numbers for the IA channel in 2018. After all, the counter-effect of re-marketing business with other carriers to Progressive has been a slowing of premium growth within the IA channel. See image three below:

Image 3: Growth (measured in market share change) for all carriers other than Progressive selling through the IA channel for personal auto insurance. Data – AM Best: Used with permission.

Market share declines are often attributed to COVID. However, it’s important to recognize that COVID emerged in the U.S. in the spring of 2020. The market share decline of the non-Progressive, IA channel started prior to COVID.

“Where is the Business Going?”

Some regional carriers are starting to ask “where is the business going?” The table below is a summary of the 2019 to 2020 change in premium for the six largest providers of personal auto insurance. The IA channel (excluding Progressive) is included for comparison purposes. The six carriers named represent 64% of the market.

Data – AM Best: Used with permission.

Written premium data in the table above represents the change in premium from 2019 to 2020. The 2020 market share is a static look at market share at the end of 2020. The IA channel data shown excludes Progressive. Progressive is excluded in order to clearly show performance of the carriers that currently make up nearly 80% of the channel.

- The non-Progressive IA channel shrank by $1.4 billion in 2020.

- Agents re-marketing business from other carrier partners to Progressive could account for up to $650 million of the $1.4 billion of lost premium.

IA Channel Conclusions

Interestingly, the data does not indicate a migration away from the IA channel in search of lower priced offerings. We conclude this for two reasons. First, the advertisers most strongly emphasizing “low price” as part of their messaging (State Farm, Geico and Allstate) also suffered declining premiums. Second, Progressive (representing the largest market share gains) is likely prevented by business agreement from taking business from their independent agents.

Competitive Raters vs. Competitors

Instead, internal competition (re-marketing) likely accounts most of the premium decline in the non-Progressive IA channel. Therefore, ValChoice concludes the single biggest competitive factor driving premium and market share loss within the IA channel is competitive raters, not competitors.

Among the top six carriers, Progressive (direct) and USAA are growing most quickly. Interestingly, USAA sells largely on a value proposition that emphasizes the user being special due to a military background and to a lesser degree, “quality.” Hence, the market requirement for “best price” may be better described as consumers want the best price, but are unwilling to do any work to get it. If the independent agent will put in the work, the consumer will happily enjoy the savings.

Where Does the IA Channel go From here?

The IA channel represents a large growth opportunity for Progressive. Importantly, relative to advertising, IA channel growth has a low customer acquisition cost. Here’s the math of advertising vs. leveraging the IA channel for Progressive:

- Assuming $1,500 average annual premium, ValChoice estimates Progressive’s cost to acquire $1 billion in additional premium at $670 million.

- Advertising requires up front payment with no guarantee desirable customers will follow.

- Acquiring an additional $1b in annual premium through the IA channel costs Progressive approximately $120 million per year in agent commissions.

- $120 million represents an 82% reduction from the estimated $670 million in advertising cost.

- Agent commissions are paid after the customers premiums are received. Effectively, this is free money.

Hence, ValChoice believes Progressive will work diligently to more fully tap the IA channel as a low-cost growth opportunity. Also, expect to see more in the way of one-time bonuses and contingency fees for business re-marketed from other carriers.

Realistically, regional carriers have limited options for fighting back against the re-marketing of their business. The reason, Progressive can offer incentives that would force combined ratios greater than 100 for small carriers attempting to match the offer.

Is the Home Insurance Business Safe?

“Home insurance is complicated. New entrants to the market won’t be able to penetrate the home insurance business as easily as auto.” ValChoice has heard statements like these many times. However, we don’t agree.

Home insurance may be more complicated than auto insurance. But, that’s a technicality. Technical issues are easily addressed. Instead, we believe the customer side of the business is more complicated to navigate than are technical issues related to underwriting.

From a customer perspective, it is easier to accelerate growth by selling more to existing customers than earning the customers business the first time. Therefore, the logical next step for Progressive is to increase the commission rate, or offer bonus pay, on bundled business. On average, agents already have 20% of their book of personal lines auto with Progressive as mono line business. Converting this business to multi-line reduces the likelihood the business will migrate to a competitor. This benefits the agent. Progressive incentivizing this behavior with increased commissions benefits all parties.

The best news for Progressive, sales channels always want more commissions. Hence, ValChoice believes the transition from a large number of small carriers to a small number of large carriers is likely to happen more quickly in home insurance than in personal auto insurance. Business migration within the channel is already underway. Now the channel just needs the right business deal.

A New Approach for Regional Carriers

More consumers shop based on quality than price, except when shopping for insurance. Insurance shoppers are no different than other shoppers. The difference is that a quality metric was not previously available for insurance shoppers. ValChoice has addressed this issue by making a reliable insurance metric readily available and easy-to-understand. The availability of a reliable quality metric has a positive effect on consumers, carriers and agencies. The positive impacts include:

- Better protection for consumers

- Minimize re-marketing

- Customer retention increases

- Agencies and carriers becoming more profitable

Next Steps

Carriers and agencies use ValChoice tools attract the best prospects and maximize customer retention. The posts listed below cover the unique capabilities ValChoice offers for carriers and agencies:

- 1st step – Brand Your Company and Win New Customers

- 2nd step – Implementing Customer Retention Programs

- 3rd step – Tell Your Company Story. Nobody Else Will.

About ValChoice Ratings

ValChoice uses data collected by the insurance industry for rating companies. Importantly, we do not employ any user surveys, nor do we use online reviews. State departments of insurance (DoI’s) vet the complaint data, making this data source the highest quality available. Most DoI’s eliminate more than half the data in the vetting process. We use only the final data set, known as “confirmed” or “justified” complaints.

A mathematical model of the industry we build enables consistent comparisons between companies. The fuel-gauge-style image is used for two reasons: 1) easy-to-understand and 2) memorable. These two characteristics make the ValChoice ratings an effective and cost efficient way to brand any high performing company.

No comments yet.