We have bad news and good news. Let’s get the bad news out of the way first. Nobody cares how long your company has been in business. In fact, in an age of rapidly advancing technology, many buyers are suspicious of companies that hang pictures of the parking lot back when it was only for horses.

Even worse, the age of your business may be a negative. In today’s market, it’s all about me. What can you do for me? And, how fast can you do it? Unfortunately, an impressive pedigree, established over decades or even centuries, can imply a lack of speed and flexibility. That’s opposite of what today’s consumers care about.

Now for Some Good News

We have three pieces of good news that will shake you to your core. Here they are:

- Insurance isn’t all about price – Keep reading. We will prove that lowest price isn’t the holy grail for insurance companies.

- Personal lines is an attractive and growing market.

- Telling your companies story isn’t hard to do or expensive – Think about Twitter. How would you sell insurance on Twitter? You have 280 characters.

1) Insurance Isn’t all About Price

Consumers make purchase decisions based on three criteria: price, features (coverage) and quality. These three criteria are shown in the image below:

Insurance sales have historically focused on price and features (coverage). This is because there was no quality metric. To visualize the relationship between price and coverage, cover the “Quality quick check” image and the plus sign. What’s left is price = coverage. By definition, this is a commodity with no unique value.

Now uncover the plus sign and the quality metric and suddenly not all insurance is equal. Best of all, with a calculated quality metric, the sales process is simplified. Most consumers will choose to pay more for better quality. The account manager, producer or CSR doesn’t have to sell quality. Quality is now a tradeoff the buyer can make. Many of our customers tell us the customers or prospects that still want the best price once they understand the quality tradeoff aren’t the customers they want anyway.

Improve your teams sales efficiency by providing quality information as part of the sales process. It will pay dividends in both the short and long term.

Proof That Insurance Isn’t All About Price

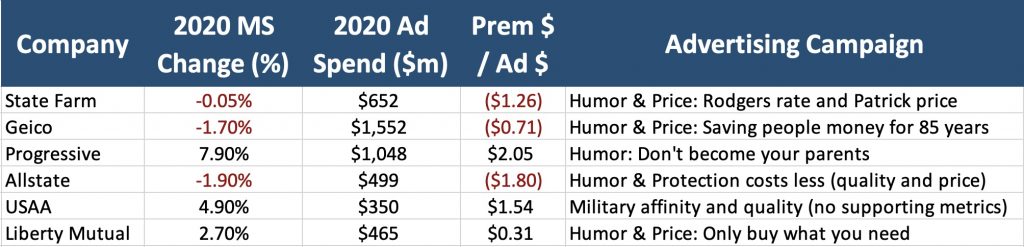

ValChoice did a cursory analysis of advertising spend by large insurance companies and how it impacted their business. Below is a chart showing the top six auto insurance companies (representing 64% of the market). The chart shows the % change in market share from 2019 to 2020, the ad spend during that same year and how much premium each dollar of advertising generated.

Market Share data, AM Best. Data used by permission. Ad spend data, Statista.

State Farm, Geico and Allstate all lost market share in 2020. Let’s analyze them first. A quick viewing of each companies ads concluded they all lead with a “price” message. Collectively, these companies spent $2.7 billion on advertising in 2020 and lost $2.8 billion in premium compared to 2019. This is a combined result of losing $1.04 of premium for every $1 spent on advertising.

“Value” Messaging is More Effective Than “Price”

Liberty Mutual took a similar approach to advertising with a slight twist. The message “only pay for what you need” leans toward being a value statement rather than a best price statement. Overall, Liberty Mutual ads performed significantly better than State Farm, Geico and/or Allstate.

The Most Effective Ads Emphasized “Protection,” “Quality” and “You’re Special”

Progressive performed the best. The Progressive ads strongly emphasize humor, but that’s not unique. Progressive’s ad themes emphasize “protection” and “bundling.” While “savings” is a clear message, a “quality” message is also present with the emphasis on “protection.”

USAA delivered the most unique advertisements. The emphasis in USAA ads is that the prospect is “special” based on their personal or family military service. The “special” message is combined with an emphasis on quality. There are no metrics for quality, so it’s a bit hollow, but the value proposition is different than simply being “best price.”

This cursory review indicates that heavily price focused ads perform worst. Hence, our conclusion that insurance isn’t all about price.

2) Personal lines is an attractive and growing market

Every consumer study we’ve seen states that more than 50% of buyers consider quality when making a purchase. In fact, many studies state the percentage is much higher than 50%. Uniquely, insurance buyers don’t have meaningful quality information available. The result is that only 31% of buyers purchase personal auto insurance from companies with a claims handling rating above 68 (shown on the gauge below).

Image of gauge representing a rating of 68. 31% of buyers purchase insurance from companies with a claims handling score above 68.

For example purposes, let’s assume only half of insurance buyers make purchase decisions based on quality. ValChoice believes this is an exceedingly low number of quality buyers. That’s okay. Even a conservative assumption makes our point.

Assuming 50% of buyers want good quality insurance, 19% of the total market is available to move to a higher quality solution. 19% of the market represents a 61% increase from the current state. Converted to dollars, this represents a $47.5 billion growth opportunity. Importantly, this is a $47.5 billion opportunity where price is not the primary consideration.

Yes, personal lines is once again a growing and attractive market.

3) Telling Your Companies Story is Easy and Affordable

The Insurance Comparison tool below is a live example of the widget carriers and agents post to web pages and social media where it can be widely viewed. This example is configured for Co-operative Insurance, auto insurance, Vermont. This is information consumers have always needed, but until now could not access.

We Did it

If you clicked the “GET MY FREE QUALITY CHECK” button, you know we did it. We just told your company story (your unique value proposition) in less than 280 characters. Yes, we can tell your company story in a Tweet (or Facebook, or Linkedin). The Insurance Comparison tool visually communicated several messages, including:

- Customers matter to your company

- You go out of your way to help your customers

- Customers matter more to your company than they do to other companies in your industry

What more powerful message could be provided to sell insurance? There isn’t a more powerful message.

Next Step – Expand Your Reach With Digital Insurance Advertising

Digital insurance advertising through ValChoice is effective due to the combination of these unique elements:

- Focus on an expanding market segment, quality

- Visually tell a compelling story that resonates with buyers

- Make the entire process simple for both users and prospects

The Results

The results advertisers are achieving through the ValChoice platform are impressive. For example, agencies advertising to audiences that buy on value (not price) are reaching 750,000 prospects per year. This impression count is achieved with an annual budget of only $2,500. Many carriers and agencies split the advertising budget. Assuming a 50/50 split, these impressions come at a cost of less than 2/10ths of a cent per impression. Quantified in the common CPM (cost per thousand) method the cost equals $1.65.

Other Unique Benefits

ValChoice tools offer even more than an emphasis on quality, ease-of-use and a compelling story. Add in the following capability, and these are tools every high performing carrier and their agents should use:

- Create ads in only three minutes to create an ad.

- Enable carriers to share ads with all agents or specific agents

- Co-brand ads

- Ad performance metric tracking available to both agents running ads and the carrier for whom the ad was created

- Track leads generated

Easy Steps to Winning More Business

Winning in the insurance business is becoming increasingly difficult. Therefore, ValChoice has written a series of articles identifying easy steps to take to win more business:

- Market overview – The Future of Insurance is Here

- 1st step – Brand Your Company and Win New Customers

- 2nd step – Implementing Customer Retention Programs

- 3rd step – This is the post you just read

A Solution Tailored to the Needs of the Best Companies and Their Agents

Changing the competitive dynamic of insurance away from price requires a high quality, comprehensive, competitive analysis database. In 2013 ValChoice was founded for the specific purpose of building this system. The ValChoice database uses only high quality data collected by the insurance industry.

User surveys and online reviews are never used due to inherent innaccuracy. Carriers use the competitive analysis in areas spanning from product planning, to marketing and advertising, channel management and customer retention. Agencies use the competitive analysis to win business away from other agencies and carriers, stop re-marketing and increase retention.

Comments are closed.