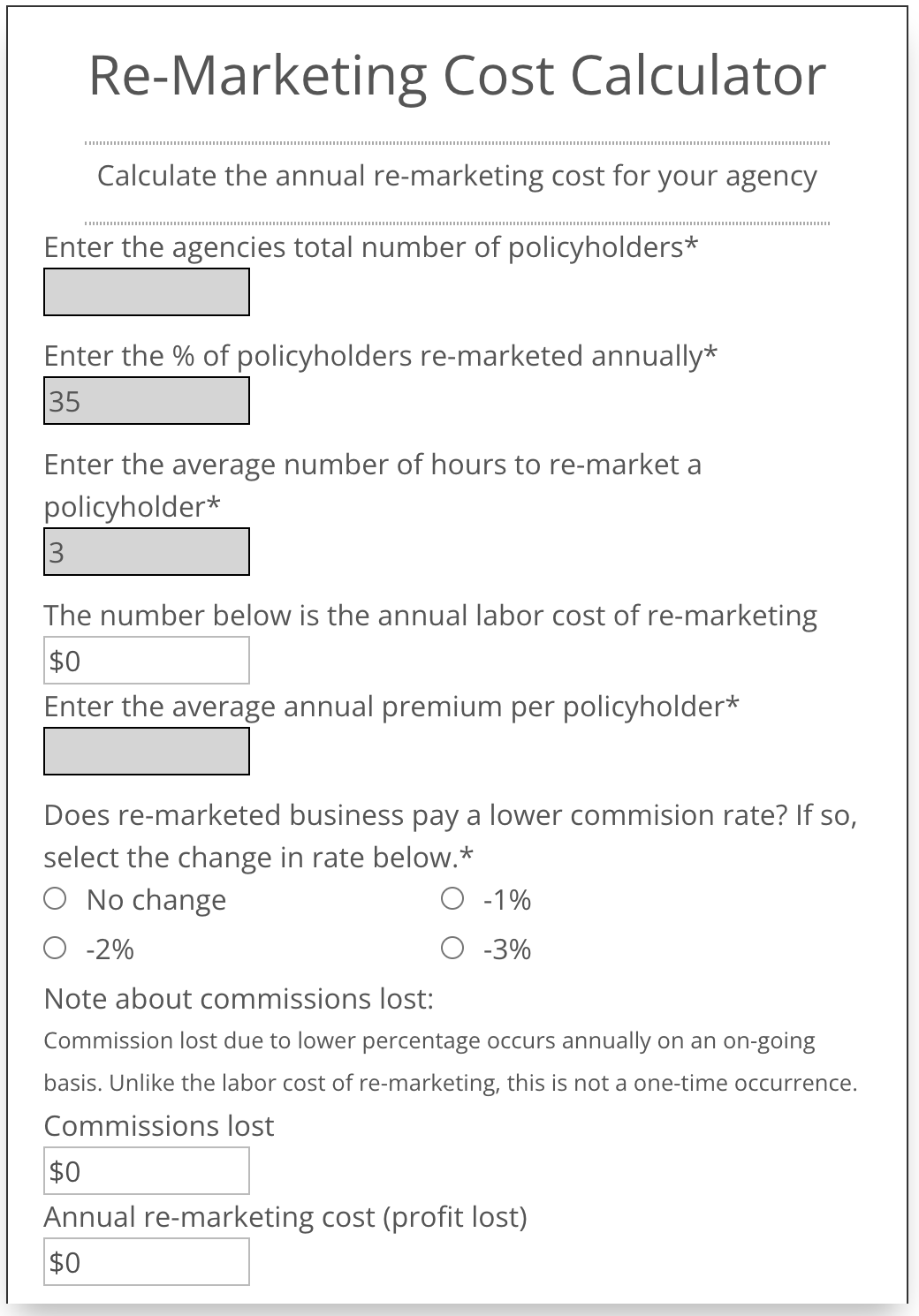

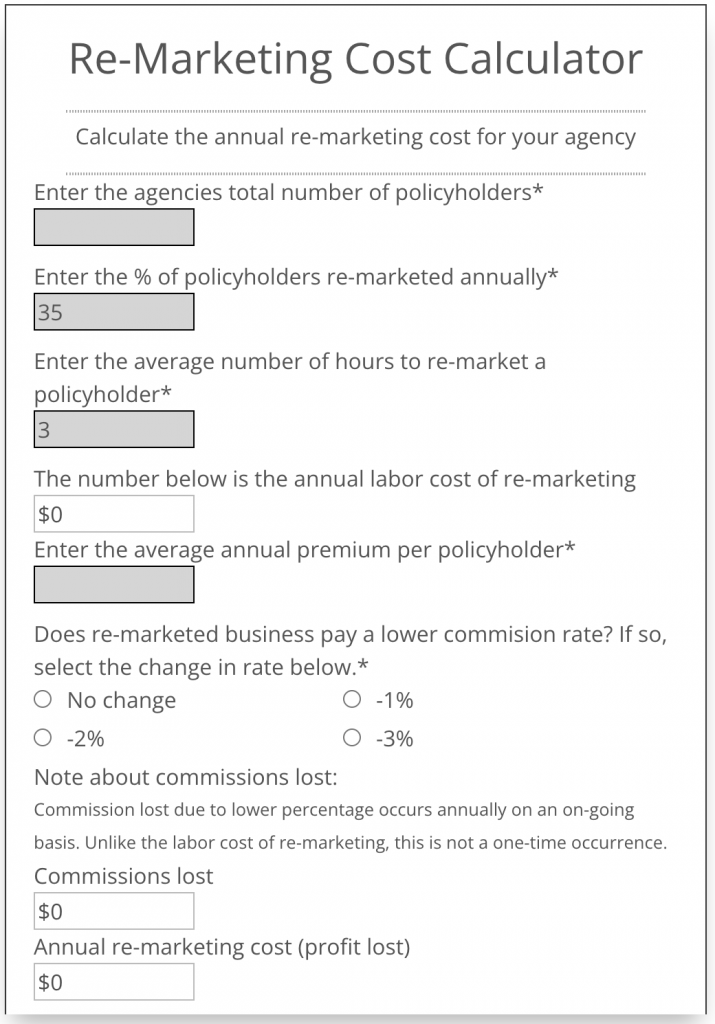

What does re-marketing cost your agency each year? Typically, the profit loss due to re-marketing is much more than anyone realizes. To find out for your agency, click this link to the “Re-Marketing Cost Calculator.” Be sure to check with colleagues on how frequently your team re-markets. In the A/B testing we do with agencies we’ve found that most agencies re-market twice as many policyholders as agency management perceives.

Calculate the Re-Marketing Cost for Your Agency

Re-marketing is an unnecessary expense. That probably sounds like an overstatement, but it is provable. Here’s why. The purpose of re-marketing is to reassure policyholders they’re getting a good value. But, price alone doesn’t determine value. Instead, value is a combination of price and quality. Therefore, what agents and brokers need are a quality metric for insurance.

Below is a screenshot of the re-marketing cost calculator. Click the image to be taken to a page with an operating version of the calculator.

Is it Possible to Stop Re-Marketing Without Changing Workflow?

ValChoice tools automate the renewal process. We send quality information to policyholders and invite them to respond to the agency if they still want to be re-marketed. This is truly a no risk approach for the agency, the policyholder and the carrier. In fact, we even offer an A/B test mode so you can split your client base and try the new approach with half of them until you see how well it works.

What We’ve Learned from A/B Testing

The A/B test mode has been invaluable. Insights gained from the testing include:

- Most agencies re-market at 2x (or more) the rate they thought they re-marketed

- Re-marketing is unnecessary, as proven by two points

- When using ValChoice tools, re-marketing requests from policyholders drops by 82%

- With no re-marketing, we’ve maintained retention at 100%

Easy Steps to Winning More Business

ValChoice offers a suite of tools for winning and retaining business in the insurance industry. To summarize these tools, ValChoice has written a series of articles identifying easy steps to win more business:

- Market overview – The Future of Insurance is Here

- 1st step – Brand Your Company and Win New Customers

- 2nd step – This is the post you just read

- 3rd step – Tell Your Company Story. Nobody Else Will.

A Solution Tailored to the Needs of the Best Companies and Their Agents

Changing the focus from price to quality and value requires reliable information that’s easy-to-understand. That’s what ValChoice offers. We were founded for the specific purpose of providing tools to agents, brokers and carriers that helps them sell quality. The ValChoice database uses only high quality data collected and vetted by the state departments of insurance. User surveys and online reviews are never used due to inherent innaccuracy. Carriers use the competitive analysis in areas spanning from product planning, to marketing and advertising, channel management and customer retention. Agencies use the competitive analysis to win business away from other agencies and carriers, stop re-marketing and increase retention.

Comments are closed.