Is your insurance agency social media strategy delivering any business? For most agencies the answer is no. This post covers how to make your agencies social media marketing a powerful new business tool.

Below are four must do items to energize your insurance agency social media strategy.

Step 1) Platform Considerations for Your Insurance Agency Social Media Strategy

There are numerous social media platforms. However, few will make a difference for your business. Below we discuss the pros and cons of the most common platforms.

Google My Business

Posting to Google My Business should be a top priority. Google My Business will help your agency be found in local search. Every insurance agency should have a Google My Business account. In fact, Google My Business may be the most effective way to be found in Google search.

Most people ages 40+ have a Facebook account. Importantly, many of these people watch Facebook daily. If 40+ is your target age group, posting to Facebook makes sense.

Instagram is owned by Facebook. However, Instagram tends to be used by audiences under the age of 40. If your target audience is 40 or younger, you should be posting to Instagram.

Linkedin is largely a business audience. From an insurance perspective, that makes Linkedin a great fit for commercial insurance. However, anyone that buys commercial insurance also buys personal insurance. Therefore, posting personal lines information on this B to B oriented platform can be beneficial.

Twitter is largely political content and isn’t regional. Therefore, posting to Twitter, if it yields interest, may not be relevant because it’s not local. Nevertheless, posting to Twitter can be a way of raising your agencies profile. However, we recommend not using any human resource to post to Twitter. The probability of business resulting from this activity is too low to justify the investment.

Step 2) Content Posted

Social media is all about quickly grabbing the viewers attention. That’s hard to do in insurance. Unfortunately, insurance doesn’t captivate social media users (or anyone else for that matter). Well, unless they had a claim denied by a carrier.

And therein lies the answer. Let users know how insurance companies perform when paying claims. This is a good way to promote insurance as part of your insurance agency social media strategy.

ValChoice built the insurance comparison tool specifically for the purpose of showing how carriers perform when paying claims. The comparison tool has several unique elements, including:

- Unique information. There’s no other source for reliable claims handling information.

- Relevant. Anyone that buys insurance needs to know this information.

- Interactive. Engaging social media users is import for two reasons:

- Interactive content is more memorable.

- Engaged users are more likely to take action.

- Interesting. The combination of being unique, relevant and interactive makes the information interesting.

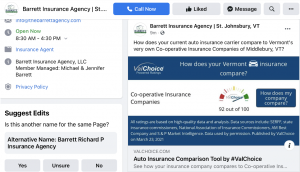

The image below is an example of the insurance comparison tool posted to an agency Facebook account.

By clicking the button that reads “How does my insurance company compare?” users can compare the company shown to their own company. Next, users that want more information can opt-in and become a lead for the agency.

Insurance agency social media posts typically include well wishes for holidays and new hire announcements. Posting unique, interactive content is a nice complement to these more traditional posts. Hence, adding the insurance comparison tool is a nice complement to your other social media content.

Step 3) How often to post?

Many agencies wonder how often they should post on their social media channels. The answer depends on the channel. Let’s look at each separately:

- Google My Business – weekly

- Facebook – weekly

- Linkedin – weekly

- Instagram – weekly

- Twitter – daily

However, often to post isn’t the only consideration. For example, you don’t want to post the same content weekly. When a viewer looks at your agencies social media feed, you want them to see a mix of content.

Importantly, the posting frequencies listed above are recommendations. Posting more often can be fine if you have a nice mix of content. Posting less often simply means your content will be viewed less frequently.

The key to managing how often you post to social media is automation. Insurance agencies should not spend time manually posting to social media channels. The reason is because there’s not enough engagement to justify the time spent. Instead, tools that automate the posting can be used. In fact, ValChoice tools include social media auto posters. Never again does someone need to regularly post to social media. Instead, set it and forget it.

Step 4) The Importance of Likes and Shares for Your Posts

Social media shares are important. Shared content is forwarded to the followers of the person sharing the content. Likes are less important than shares. Likes are useful for helping follow-on viewers decide whether to engage with the content. However, likes are not as effective as shares for widely distributing your content.

Getting users to share social content is important. One way insurance agencies get followers to share content is with giveaways. For example, users that share your content are entered into a drawing for a giveaway. Importantly, the giveaways must be relatively low value. The reason, most state regulate the value of gifts used to draw clients. However, a relatively inexpensive gift card can significantly expand social media engagement.

Other Digital Marketing Considerations

Lastly, advertising is only part of the online strategy for insurance agencies. Read these other posts for a complete digital marketing strategy:

- Website – Does my insurance agency website need updating?

- Search Engine Optimization – Five Steps to Maximize Insurance Agency SEO

- Blog – Does my agency website need an insurance blog?

- Advertising – Should insurance advertising be part of my agency budget?

- Email Marketing (often referred to as marketing automation)

ValChoice tools address all of these needs. Click the button below to schedule a demonstration.

Comments are closed.