After attending several HUG national and regional meetings, the common complaint about automation software is “it’s too hard to use.” Whether users are from Columbus, Salt Lake, Syracuse or Milwaukie, they are all suffering the same issue. In Cleveland an agency team member explained how the agency owner assumed the burden of using the automation system for the entire agency. In effect, the owner manually performed the function of the expensive automation system. The owner stood there sheepishly listening to the story without saying a word.

Click this button to schedule a time to learn more about ValChoice and get a demonstration.

3 Rules for Choosing an Automation System

Below are three simple rules for finding an automation system that will benefit the entire agency staff.

Rule 1 – No New System/Interfaces to Learn

This rule is critical. Users (the agency staff) cannot be required to learn a new interface. Many readers may be thinking “that’s impossible” to embrace automation without learning a new system. Actually, the HawkSoft two-way API makes this possible.

Here’s an example of how this works. Let’s assume your agency is running a campaign. It could be any campaign: upsell, cross sell, book consolidation, win back, etc. The most important step is making sure someone follows up with clients expressing an interest. Importantly, this is also where most automation systems break down (yes, this is also where that agency owner in Cleveland became the manual automation system as discussed in the opening paragraph). The problem with most automation systems is they either email the user (email, where action items go to die) or set the task in their automation system, where none of your users go – and probably won’t go for love nor money – because it’s not part of their workflow.

The Process That Works – Really Well

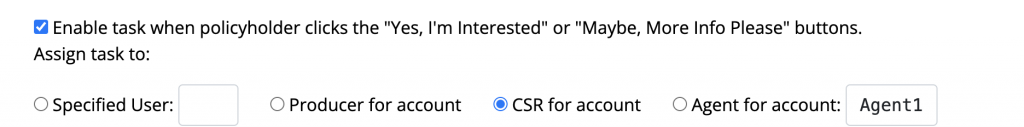

This is where the HawkSoft two-way API comes to the rescue. With ValChoice, during setup of the automation the user that created the campaign selects to whom follow up tasks should be assigned. See image 1 below for an example of our task assignment process.

Image 1: Screenshot of the task setting pane in ValChoice tools. The user creating the campaign can assign follow up to any of the roles shown above. The person/role identified will have a task for follow up set in HawkSoft.

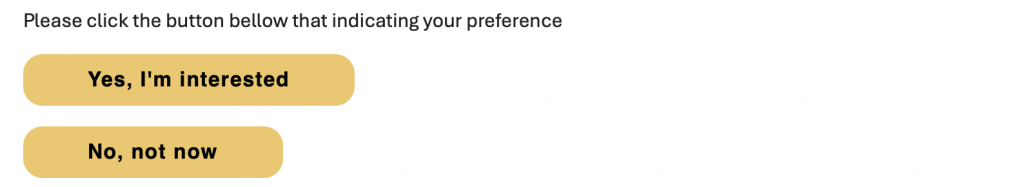

When the policyholder is interested, they click a button. See Image 2 below for an example of the button click option from the email.

Image 2: Example of button options that can be included in the email.

Their button click sets a task (formerly known as a suspense in HawkSoft) for the person/role specified in image 1. No one had to learn anything new. In fact, no one has to do anything new. When your user logs into HawkSoft and checks their tasks, there it is. They have all the history: the email sent, what was offered and the clients interest.

The agency is now automated, but the team works in exactly the same way they worked before with nothing new to learn. Click the button below to schedule a time to learn more about ValChoice and get a demonstration..

Rule 2 – Simplify for Both the Agency and Client

“Simplify.” It sounds easy, but it can be hard to do. The magic behind simplifying is automatically triggering events based on policy data. This rule defines the difference between “marketing” automation and “business” automation. Until now, automation systems were marketing automation.

Insurance sales has changed though, and automation systems need to catch up. For example, underwriting changes from many carriers are commonplace. Also, carriers exiting markets has become commonplace.

Image 3: Insurance was always complicated. Now it’s become like a complicated relationship. Automation needs to simplify.

The important point is that automation systems need to identify these changes in the API data stream and take action to automate client notification. This requires a combination of a well defined, precisely implemented API (like HawkSoft API V3) and an automation system with the built in intelligence to fully utilize the information the API provides (like ValChoice).

We will use Grange as an example for needing this capability. Grange implemented a complex set of underwriting changes for home insurance. The John Dawson agency estimated communicating these changes to clients would consume 500 hours of agency time throughout the course of 2024. Kelly Endicott, the agency owner, was thrilled that our automation reduced this to only a couple of minutes. That’s a couple minutes, IN TOTAL, not per client.

Rule 3 – Save Significant Time for Agency Staff

The third rule of automation is it needs to be obviously beneficial. If anyone wonders “was that worth the time and money to implement” the answer is that it wasn’t.

Image 4: Agency staff is continuously under time pressure, especially in the current market. Automation systems must ease this burden.

At ValChoice we were fortunate to have Grange Insurance run a pilot test on the effectiveness of our “Renewals” automation. We have multiple renewals automations, in this case we’re referring specifically to the automation designed to enable agencies to stop re-marketing. Below is a description of the test and the results.

Grange challenged us to increase retention to 88% PIF in two years’ time. Starting Nov ’22, we began a test where half of the policyholders received ValChoice ratings two weeks prior to the rate increase. The other half went through a normal process, but the agency did not offer to re-market. Grange agents immediately experienced an 80% reduction in re-marketing requests from policyholders that received the ValChoice ratings two weeks ahead of rate increase information. From then until now (17 months) Grange and the agencies have beaten the 88% PIF retention goal by a full ten points.

Again, the two-way API is critical. ValChoice posted in the HawkSoft log notes the email we sent to clients and when it was sent. In the case of clients that did not receive anything – group B of the A/B test – that was also posted.

CLICK HERE to use our calculator estimating how much stopping re-marketing could increase the profits of your agency.

The Market Has Changed

No one needs to tell you the market has changed. You live it every day. Unfortunately, what we see are a lot of agencies trying to address these changes manually. That’s hard on agency staff. It’s also unnecessary. Consider the example given for Rule #2, Simplify. We reduced an estimated 500 hours of communication time to a couple minutes. Dare I say that this automated system will be just as effective as a human. In fact, based on our “stop re-marketing” performance measurements, it appears our automations are more effective than most humans.

As you rethink the options for addressing the current market, here are the options:

- Increase staffing to maintain the current service level

- Reduce the service level provided – some agencies are actually entertaining not communicating significant significant changes in coverage.**

- Use a CMS / automation system capable of dealing with the changing market

As a vendor that works deep in the bowels of the HawkSoft API on a daily basis, we can attest to the fact that the HawkSoft API enables ValChoice to provide agencies the automated tools they need to run the agency both more effectively and more profitably.

Thinking Like a Consumer

**The double asterisks after point 2 (the service level…) in the section above titled “The Market Has Changed” leaves the author feeling compelled to comment from a consumers perspective. For those that haven’t heard my backstory, it involves lawyers, lawsuits and insurance companies. After I was hit by a car, the insurance companies were unwilling to reimburse the cost of the medical bills. Coverage was not the issue. That was clear. However, the attorneys insisted on knowing when and how coverage changes had been communicated. They also insisted it mattered. In reality, it probably mattered only because they wanted more money if they could get it. I just wanted what I’d paid in medical bills back. I did not want to pull my agent into the legal fight. However, the attorneys insisted.

My take away from this is that both agents and carriers need to take care in communicating coverage changes that are currently broadly occurring in the industry. It’s hard for either agents or carriers not to look “sneaky” in the eyes of an upset client. This is not meant to pass judgement, it’s just a voice of experience from a different – and important – perspective.

Links

Below are links to other popular posts for insurance agents on this website.

- Do You Wonder “Are we Re-Marketing Too Much?”

- HawkSoft Insurance Perspectives Podcast – ValChoice, Part 1

- HawkSoft Insurance Perspectives Podcast – ValChoice, Part 2

Comments are closed.