“Are We Re-Marketing Too Much?” This is the question many agents and agencies are asking these days. Rapid rate increases are leading policyholders to request their agent to re-shop their business. However, is that the right move for the policyholder? And, is it the right move for the agency? This article considers re-marketing from both the policyholder and the agency perspective.

The Policyholder Perspective

The ultimate policyholder perspective is my personal story. Here’s the short version. I was hit by a car and no insurance company would pay my medical bills. While ValChoice wouldn’t have helped me avoid being hit by the car, it definitely would have let me avoid the financial nightmare that followed. I would have known my underinsured motorist coverage was from a company that didn’t perform well when paying claims. Hence, they wouldn’t have been my insurance company.

By providing a simple, accurate, quality metric, a strong argument for better quality now exists. No reasonable person wants to live my experience. Occasionally we hear consumers don’t care about quality. They only care about price. That’s because they never had a quality metric. Now that consumers have a quality metric, our testing shows 80% of consumers do care about quality. More on the testing done by ValChoice later.

How Does Claims Handling Performance Help Independent Agents?

Generally speaking, direct writers don’t score well on claims handling performance. Since direct writers represent more than half of the auto insurance market and nearly half of the home insurance market, analysis of claims handling performance provides independent agents with a powerful differentiator. Especially when prices are going through the roof. Independent agents can now shout from the rooftops “dear prospect, you’re going to pay more no matter what you do. You may as well get better insurance for the money you’re spending.”

SPECIAL OFFER: The rest of this post gets into detail on how to analyze the impact of re-marketing on your business. Maybe you don’t have time for the details. No worries. ValChoice will do this analysis for you. No charge.* There is no change to workflow and no retraining of personnel required. We’ll do the work. If you want to increase the cash flow or value of your business while also increasing customer satisfaction, click the button above to learn more.

The Agent Perspective – Does Re-Marketing Increase Retention for Agencies?

Carrier retention (not agency retention) rates are approximately three times lower in the IA channel than in the captive channel. This means approximately two-thirds of policyholders for whom agents re-shop insurance would not re-shop if they had to do the work to re-shop themselves.

Viewing this from the perspective of the agent, captive agencies have approximately double the customer loss rate (measured in percentages) than independent agencies. Therefore, the answer to the question is: yes, re-marketing increases retention for the agent.

Independent agents should note that approximately two-thirds of the re-markets they are doing are for clients that don’t care enough to re-shop their own insurance. Is re-marketing the right customer retention strategy for these clients? To figure this out, there are three considerations:

- What does re-marketing cost?

- Are the customers kept through re-marketing worth keeping?

- What are the alternatives to re-marketing?

Keep reading, we address all three points below.

1) Answering the Question: What Does Re-Marketing Cost?

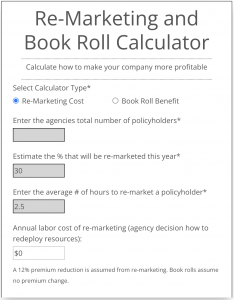

Checkout the ValChoice re-marketing cost calculator. Enter your own assumptions to estimate what re-marketing is costing your agency.

The calculator answers the question on how much re-marketing is costing your agency. Whether the cost is acceptable is entirely up the the agencies management team. One consideration is whether the needed resources to offer re-marketing as a service are available within the agency.

2) Are the Customers Kept Through Re-Marketing Worth Keeping?

Determining this depends on the definition of your agencies ideal customer, and whether the customers kept through re-marketing fit this definition. As a way of testing to determine if you’re keeping the right customers, we suggest the following:

- Separate your customer data base into two groups:

- Segment A: recently re-marketed and stayed with the agency, for a lower price.

- Segment B: did not request to be re-marketed and stayed despite higher prices.

- Next, test the quality of these two customer segments as follows:

- First, calculate the average annual premium for each segment

- Then, use ValChoice tools to run fully automated cross sell and upsell campaigns to both groups.

- After running the campaigns above, re-calculate the average annual premium for each segment after running these automated campaigns. Did one segment embrace up selling and cross selling more than the other? Click this link for more information on ValChoice tools.

This process will give you a clear view of the differences between customers that do/don’t expect to be re-marketed. We predict you’ll be able to easily determine where to focus your efforts for growing the business.

3) Is There Another Way to Keep Customers Without Re-Marketing?

Yes, it’s possible to keep customers without re-marketing. In late 2022, ValChoice partnered with Grange Insurance and several agencies representing Grange to test customer retention for two scenarios:

- Group A – The policyholder receives a ValChoice insurance quality rating a couple weeks before receiving the rate increase

- Group B – The policyholder does not receive a ValChoice rating and the agent does not proactively offer to re-shop the business. This is measuring the natural re-marketing request rate.

The Results

The group that received the ValChoice information (group A) prior to the rate increase information had 80% fewer re-marketing requests than group B. Best of all, retention was 98% for both the carrier and the agencies. This is 98% based on policy count, not premium. Using the ValChoice automated system resulted in excellent retention for both the carrier and the agency. Importantly, the opportunity to request being re-marketed was not removed. Instead, the ValChoice information was provided along with an offer to review the policyholders account.

Selling Insurance is Like Selling Wine

When I go to the store to buy wine, I’m shopping for a bottle between $12 and $19 (just like insurance, price is the #1 criteria). I look at the shelf with the $12 to $19 bottles and have no idea if any of these bottles are any good (just like insurance, it’s confusing). Then, out of the corner of my eye, I see a sticker on the shelf above saying Wine Spectator rated this bottle a 92. This is the type of transparency that ValChoice provides with its insurance ratings. But, the bottle with the 92 rating costs $25. It’s okay. I don’t care. I trust that it won’t be a waste of money. It’s good quality. This same dynamic is why 80% fewer policyholders request to be re-marketed after receiving a ValChoice rating.

Take care not to sell a $12 bottle of wine to $25 bottle of wine customer. The customer will likely be unhappy, which means everyone will be unhappy. Instead, think of selling insurance as being like selling fine wine. Watch these pages. Maybe we should offer a “Purveyor of Fine Insurance (PFI),” certification for users of ValChoice tools. This designation will identify agents with the highest retention rate, most new business, most satisfied customers and happiest carriers (due to low customer churn which equals increased profitability). For those that don’t know me, this is my dry sense of humor on display.

Special Offer

SPECIAL OFFER: *Sign up with ValChoice by December 31, 2023 and we will run the tests and perform the analysis that shows you how to optimize your customer retention, minimize your re-marketing and maximize the profitability of your agency. We will run the tests to show you what’s possible. You get to decide what you wish to implement. Best of all, with ValChoice, no retraining of personnel or change of workflow is required. We will give you the data to make the decisions easy.

The image for this post is from Wine Spectator magazine and can be found at this web location, https://www.winespectator.com/articles/right-price-for-wine-depends-who-is-buying.

Comments are closed.