Technologists say that car insurance agents will go the way of travel agents. At the same time, many in the insurance industry cite statistics saying agents are experiencing a revival. These differences of opinion are enormous. To shed light on the real trends, we dug into the data. Now we’re sharing the trends, state-by-state.

What the Data Says About Car Insurance Agents

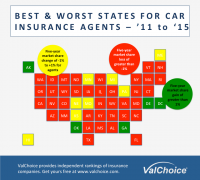

We looked at the five-year trend from 2011 to 2015 for consumer auto insurance. Here’s what the data* tells us:

- Four states plus Washington, D.C. had an increase of greater than 1% market share for agents

- Eight states had between a 1% market share loss and a 1% market share gain for agents

- In 38 states agents lost more than 1% market share

In summary, the number of states where agents are losing market share is nearly ten times the number of states where agents are gaining market share. That’s the trend. Now the question is, what can agents do to protect their business and their clientele?

Click this link to subscribe to our blog and get interesting information from us delivered by email.

What Should Car Insurance Agents do Now?

Deliver transparency and maintain service. Service is no longer a differentiator, it’s expected. Many agents and agencies have numerous examples of the excellent customer service they provide. Importantly, the examples are true. However, good service is no longer good enough. That’s why despite the great service, agents are losing market share in ten times as many states as they’re gaining market share.

That brings us to transparency. Transparency builds trust and loyalty. The challenge for agents is transparency in the insurance industry has never been available. Therefore, transparency couldn’t be used as a means to differentiate the best companies from the worst. To find out if transparency will benefit your company, click the button below and get a report on any company for whom you sell car insurance.

That’s all changed. ValChoice analytics are used to rate companies on their price, protection (claims payment history) and service. We analyze every car insurance company in the industry. The analytics are done by state so consumers know exactly what they’re buying.

Sharing this information with clients builds trust and loyalty. As Forbes says, ValChoice is “Carfax for insurance.” Carfax reports are provided by the dealer, building trust with the customer. Now insurance agents have a similar opportunity to build trust and differentiate from their competition.

To find out if your agency could benefit from ValChoice tools for insurance agents, click this link and run a report on the companies whom you represent for car insurance. You will know immediately if ValChoice can help your business. Be sure to get the premium report so you have the same information your customers have, before they start asking you questions.

*Source: AM Best, Used by Permission

Comments are closed.