The tech stack for insurance agencies is complex. Too complex. An example of the unneeded complexity is the user interface for managing customer data. Whether using an AMS/CMS, or CRM, or both, the functionality is almost identical. Both put a user interface on top of a data base for managing policyholder and prospect data.

Yes, the AMS/CMS and CRM functionality are nearly identical. This may lead you to ask, why are they different systems? Read on. We answer that question in this article.

Why do AMS/CMS and CRMs Exist Separately?

The reason AMS/CMS and CRM systems exist separately is simply a matter of how the industry has evolved from being a manual to a partially automated process. Software companies developed AMS/CMS systems as digital filing cabinets. Later in time, CRMs – broadly used in other industries – customized their solutions to address insurance markets. This evolution resulted in separate systems for the reason that AMS/CMS and CRM systems have historically been provided by different suppliers.

The important point to note here is there is no technical reason necessitating separate systems. Therefore, separate user interfaces are simply a matter of each supplier wanting to own the user interface. The sticky part of the sales transaction.

Click this button to schedule a time to learn more about ValChoice and get a demonstration.

Does my Agency Need Both an AMS/CMS and CRM?

No, for most agencies, working within a single system is better for multiple reasons:

- No new interfaces to learn. The agency team can continue to work in the system which they are already familiar.

- Easier to manage the agency team since a single system tracks progress and performance.

Are There Single Interface Systems Available?

Yes. First, the AMS must have a robust two-way API, like the HawkSoft API. ValChoice uses the HawkSoft API extensively to simplify usability for HawkSoft agents. This is done by writing both log notes and policyholder correspondence into HawkSoft. However, the system does much more. For example, HawkSoft tasks enable action items to be assigned to specific users. Hence, ValChoice delivers a system with a single user interface for the agency team. Users never need to check ValChoice or their email to find their action items.

Use Case Example: Underinsured Policyholders

The use case below shows how to create an upsell campaign. In this example, one agency team member creates the campaign. Only that person needs to know how to set up ValChoice, or even how to log into ValChoice.

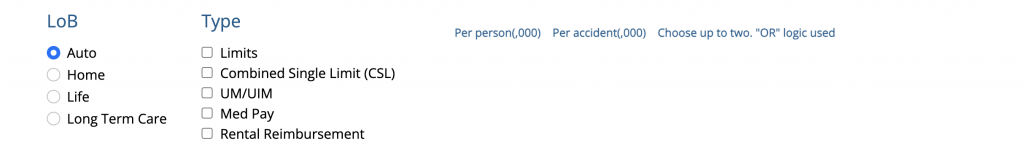

One effect of inflation is that many policyholders are now underinsured. The following example highlights the upselling options for auto insurance within the ValChoice system. First, users simply select the type of coverage they wish to upsell. Image 1 below shows the options when creating an auto insurance upsell campaign:

Image 1: Screenshot of the auto insurance coverage upselling options within ValChoice

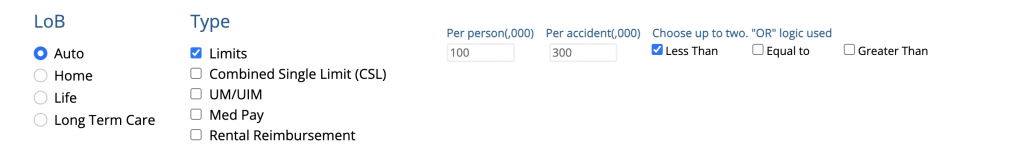

Next, set the filters identifying which policyholders to contact. Creating a campaign that will be sent to policyholders with less than 100/300 coverage limits is shown in image 2 below.

Image 2: Set the parameters for which users to contact about upselling.

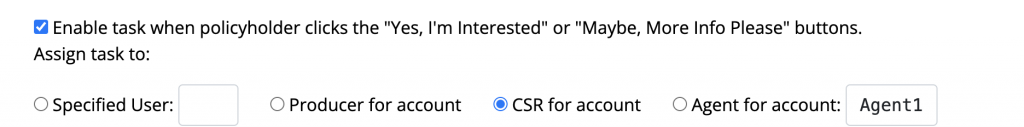

Last, select to whom follow up action items will be assigned. ValChoice assigns action items when the policyholder indicates an interest in moving forward with the upsell. Hence, agency personnel only needs to follow up with policyholders who opt-in to the upsell.

Image 3: Screenshot showing how to select the role of the person assigned to follow up when a policyholder expresses interest in moving forward.

How One Agent Uses the ValChoice/HawkSoft System

John Dawson Insurance from Columbus Ohio has been using ValChoice since November of 2022. They use the system in several ways, including:

- Retention – An 80% reduction in the number of clients requesting to be re-marketed using the ValChoice renewal automation was proven with A/B testing. This translates into Policy in Force (PiF) retention of 97% for Travelers and 98% for Grange.

- Cross-selling life insurance – An automated campaign sells life insurance to existing policyholders.

- Upselling – An auto insurance upsell automation running since November of 2023 has averaged a 17.4% opt-in rate by policyholders. This is five times more opt-ins than CRM systems typically deliver.

- Book consolidation – This became necessary due to an acquisition of a carrier the agency represented by a carrier with whom they did not have a contract. Manually the book consolidation was proving difficult. Many policyholders did not want to be moved. Within only a few days of starting the automation, 22% of the book had opted-in, accepting the move to a different carrier.

- Underwriting changes – One carrier came up with a very complex underwriting change. The change modified both wind hail and all peril deductibles. The new deductible amounts were calculated based on both the coverage A value of the home, and whether there were also cars insured. This process was a complex calculation, making it perfectly suited for automation. Communicating these changes to policyholders was estimated to take 500 hours of agency personnel time. ValChoice automated the communication and returned 500 hours of labor time to the agency for upselling, cross-selling, etc.

- Customer Referrals – Now that some carriers are starting to have an appetite for new business, the agency started a customer referrals campaign.

Summary

Agency owner, Kelly Endicott, summarizes how they use ValChoice with the statement “I don’t know how we would run the agency without ValChoice. After trying several automation systems, we’ve found the combination of ValChoice and HawkSoft to be both the easiest to use and the most effective.”

No comments yet.